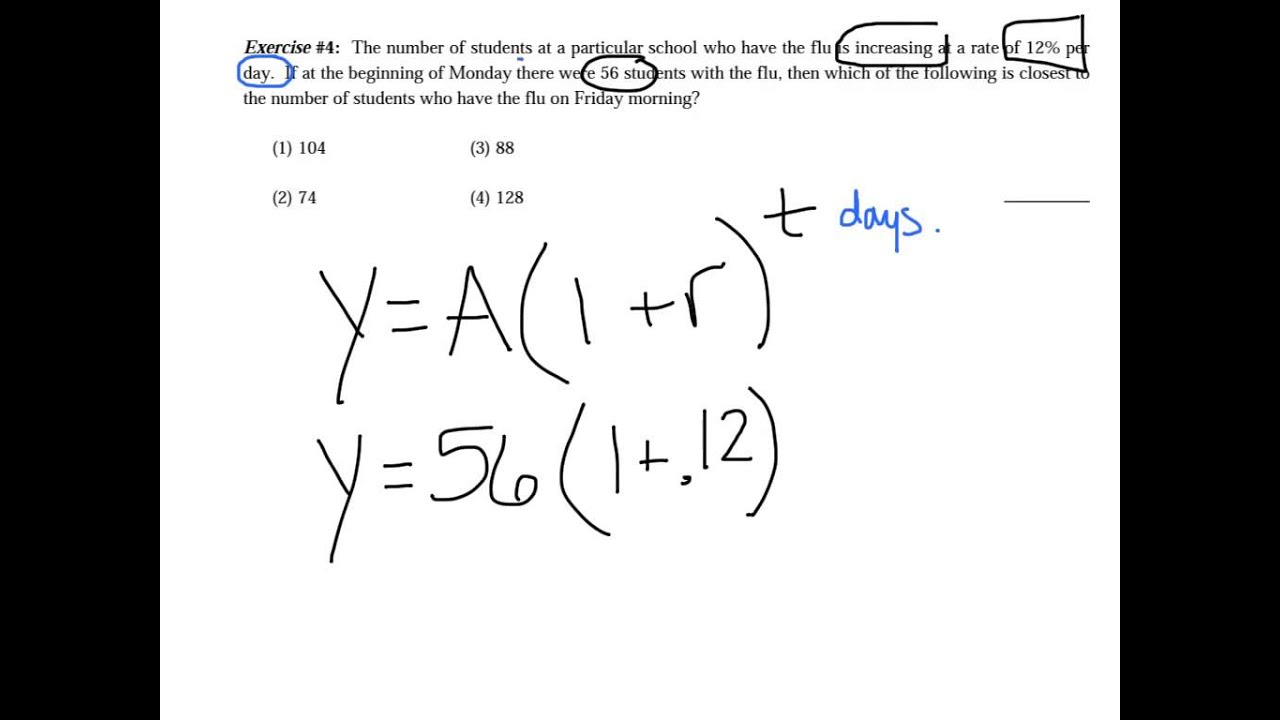

Diminishing method formula

Diminishing Balance Method The formula for the diminishing balance method of depreciation is. Depreciation amount book value rate of depreciation100.

Graphing Rational Functions Cheat Sheet Rational Function Rational Expressions Teaching Algebra

Carpet has a 10-year effective life and you could calculate the diminishing value depreciation as follows.

. Under the straight-line depreciation method the company would deduct 2700 per year for 10 yearsthat is 30000 minus 3000 divided by 10. Multiply the book value by the depreciation rate. Formula to Calculate Depreciation Value via Diminishing Balance Method The formula for determining depreciation value using the declining balance method is- Depreciation.

Book Value Diminishing Method. The accumulated depreciation for Year 2 will. November 29 2020 - 132 am.

A company has brought a car that values INR 500000 and the useful life of the car as expected by the buyers is ten years. Some of the merits of diminishing balance method are as follows. Now as per the straight-line method of depreciation.

Diminishing Balance Method Example. Assets cost x days held. This depreciation method calculates the decrease in values of an asset over its effective life at a fixed rate per year using the following formula.

Depreciation Rate Book Value Salvage Value x Depreciation Rate The. If the asset cost 80000 and has. Determine the depreciated value of the transformer at the end of 20 years by using diminishing value method.

R230 000 cost price R46 000 depreciation written off to date R184 000 real value x 20 percentage R36 800 depreciation for year 2. Cost of the asset 100000 Salvage Value 11000 The useful life of the asset 8 years Depreciation rate 1useful life 100 18. When using the diminishing value method you would record the final years depreciation as the difference between the Net Book Value at the start of the final period.

Recognised by income tax. And the residual value is. Solution Given Initial cost of transformer 𝑃 Rs.

Year 1 2000 x 20 400 Year 2 2000 400 1600 x. Subtract Scrap Value from the Asset Cost. Assets cost days held365 Depreciation rate.

Under this method the asset is depreciated at fixed percentage calculated on the debit. The following formula is used for the diminishing value method. Formula to Calculate Depreciation Rate To calculate the depreciation rate divide the 1 by the.

Diminishing balance method is also known as written down value method or reducing installment method.

Algebra 2 Worksheets General Functions Worksheets Algebra 2 Worksheets Algebra Word Problem Worksheets

Exponential Growth And Decay Word Problem Worksheets Word Problems Linear Function

Newton S Method 3 Newton Method Method Real Numbers

Graphing Rational Functions Cheat Sheet Rational Function Rational Expressions Teaching Algebra

Luxurious Easy Homemade Lotion No Heat Method Homemade Lotion Homemade Body Butter Body Butters Recipe

Youtube Method Class Explained

Pin On Bepressnews

Rakib On Twitter Adwords Diminishing Returns Budgeting

Pin On My Posh Closet

Pin On My Posh Closet

Mothers Day Gift Pamper Moms Eyes Rodan And Fields Rodan And Fields Consultant Rodan And Fields Rodan And Fields Business

Pin On Economics

Graphing Rational Functions Reference Sheet Rational Function Rational Expressions Teaching Algebra

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Fixed Asset Cash Flow Statement

Exponential Growth And Decay Word Problem Worksheets Word Problems Linear Function

Pin On Buyonlinecare Com Keto Advanced Canada

Visit Us At Teameffortnetwork Biz Vitamin D3 Vitamins Health